Available Student Aid

ICC participates in a variety of financial aid programs and work to connect students with financial aid resources that best fits a student's need.

ICC offers Federal Pell Grants and Federal Supplemental Education Opportunity Grants (FSEOG) to students.

Federal Pell Grants are grants for students who demonstrate financial need as determined by the Free Application for Federal Student Aid (FAFSA). Federal Pell Grants are awarded on an annual basis and up to one-half of the award is disbursed each term as long as the student otherwise qualifies for the grant funds.

To be eligible for Federal Pell Grants, the student must:

- Meet basic Federal Student Aid eligibility criteria

- Demonstrate financial need

- Make Satisfactory Academic Progress

- Complete verification (if selected for verification)

- Be attending class(es)

The Federal Pell Grant award amount is determined by taking into consideration:

- Your Expected Family Contribution (EFC)

- Your year in school

- Your enrollment status (full-time, half-time, etc)

- Your cost of attendance at ICC

Federal Supplemental Education Opportunity Grants (FSEOG) are for students enrolled at least half time and demonstrating financial need. FSEOG are awarded to students in the following manner:

- On Campus Residents are allotted 75% of ICC's total FSEOG funding. Funds are awarded to students with an Expected Family Contribution (EFC) of '0' who will receive a Federal Pell Grant in the award year; followed by students with an EFC of '0' who will not receive a Federal Pell Grant in the award year. Most On Campus Residents receive $600 per year in FSEOG.

- Off Campus Residents are allotted 25% of ICC's total FSEOG funds. Off Campus Residents are awarded in the same priority order as On Campus Residents. Most Off Campus Residents receive $300 per year in FSEOG.

- FSEOG funds awarded in the Summer term are awarded in the same manner as Spring/Fall terms, but the award amount may vary depending on funding availability.

ICC offers a variety of academic, co-curricular and athletic scholarships. In addition to institutional scholarships, the ICC Foundation awards several thousands of dollars to students in scholarship each semester.

Find more information about ICC and ICC Foundation Scholarships on our webpage HERE, including information on qualifications, application and policies for receiving an ICC Scholarship.

The Federal Work Study (FWS) program is a need-based student employment program. The FWS program provides students the opportunity to work part-time on the ICC campus. Students can work up to 29 hours per week, depending on eligibility. Jobs are located mainly on-campus, but a few off-campus positions are available. Pay rate varies based on position, but begins at $14.00/hour; students are paid on a monthly basis.

ICC Faculty and staff who wish to request a Federal Work-Study Employee should complete THIS online request.

Application

- Students must have a complete and verified FAFSA on file with the Office of Student Financial Aid.

- Eligible students will be invited at the beginning of each term to participate in our Federal Work-Study program.

- Students must disclose any and all outside aid awards.

- Students must complete all payroll paperwork prior to beginning work on campus.

- Government Issued ID

- Original Social Security card or birth certificate

- Voided check or deposit slip OR bank’s phone/fax number

- K4, W4 and I9

- FWS Authorization Form

- FERPA Training

- Block Schedule

- Students must have special permission to work on campus during the summer term(s).

Student Labor

Students ineligible for the FWS program may qualify for ICC’s institutional student labor program. Students otherwise not eligible for FWS should complete the same application process above.

Employment Opportunities

- Maintenance/Groundskeeper

- Inge Center

- Resident Hall Assistant

- Theatre Department Assistant

- Music Department Assistant

- English Department Assistant

- Math/Science Department Assistance

- Computer Lab Assistant

- Library Assistant

- Financial Aid Assistant

- Business Office Assistant

- Registrar Assistant

- Admissions Assistant

- Student Life Assistant

- Athletic/Game Management

- President’s Office Assistant

- Recreational Fitness Assistant

General Conditions and Terms of Student Employment

- Student employment at ICC is seasonal and/or temporary, and student employees may be dismissed for any reason at any time with or without notice.

- If employed by ICC, students agree to: show up on time and work prescribed schedule; to work in a law-abiding manner; to perform work as directed by college supervisor; and to make reasonable accommodations with supervisors to be absent from work.

- A list of all college policies and procedures are available from the Office of Human Resources.

- Student employees are not eligible for any college benefits and do not qualify for unemployment benefits based on the position of a student worker at ICC.

- The level of financial aid received may affect the level of other financial aid a student is eligible to receive.

- Student employees are not allowed to work during class times, even if class is cancelled or lets out early. Changes to students’ schedules must be reported to the Office of Student Financial Aid.

- Applicants for admission and employment, students, parents, employees, sources of referral of applicants for admission and employment and all unions or professional organizations holding negotiated agreements or professional agreements with the institution are hereby notified that this institution does not discriminate on the basis of race, religion, color, national origin, sex, age or disability in admission or access to, or treatment or employment in its programs and activities. Any person having inquiries concerning Independence Community College's compliance with the regulations implementing Title VI, Title IX and the Americans with Disability Act of 1990 is directed to contact the coordinators who have been designated to coordinate the educational institution's efforts to comply with the regulations implementing these laws.

- Students must meet Satisfactory Academic Progress

ICC participates in the Federal Direct Loan program. Federal Direct Student Loans may by borrowed by qualified students enrolled at least half-time in eligible certificate or degree programs. Federal Direct Student Loans are to be repaid by students regardless of whether the student is successful in completing the program of study or obtaining employment.

General Information about student loans may be found at the following:

- Federal Student Aid information

- Loan Counseling, Application and Repayment

- Student Loan Repayment

- Comparing Loans

- ICC Student Loan Code of Conduct for ICC, its Employees and Affiliated Organizations

Federal Direct Subsidized Loans

- Subsidized loans are need-based loans calculated using your Expected Family Contribution (EFC) from the FAFSA, your cost of attendance and other eligible financial assistance.

- Interest on your student loan is paid by the government while you are in school, as long as students complete their program of study. Subsidized loans are the preferred loans because of this benefit.

- Payments are deferred until students graduate, leave school or fall below half-time enrollment.

Federal Direct Unsubsidized Loans

- Unsubsidized loans are not need-based loans calculated using your cost of attendance and other eligible financial assistance.

- Unsubsidized loans will accrue interest while in school.

- Payments are deferred until students graduate, leave school or fall below half-time enrollment.

Federal Direct Parent PLUS Loans

- A parent of a dependent student may apply for a Parent PLUS Loan

- General information about Federal Direct Parent PLUS Loans may be found here

- To apply for a Federal Direct Parent PLUS Loan, the parent must complete the Parent PLUS Loan application online at https://studentaid.gov/plus-app/.

- Parents requesting a Federal Direct Parent PLUS Loan will be contacted by the Office of Student Financial Aid by email once the request has been received.

Accepting (Borrowing) Federal Direct Student Loans

- Student may accept (borrow) student loans by accepting the desired loan amount in their Online Financial Aid System or by completing a Loan Adjustment Request Form in our office.

- The student should navigate to the “Accept My Awards” section, input the amount of loan request, accept the award, and submit the acceptance to our office.

- Traditionally, Federal Direct Student Loans are offered as an annual award, i.e., a loan to cover both the fall and spring term. Therefore one-half of the requested amount will be disbursed to the student in the fall and the other one-half will be disbursed to the student in the spring.

- First time borrowers must complete Direct Loan Entrance Counseling and are subject to a 30-day waiting period from the start of their enrollment period before loan proceeds will disburse.

- All borrowers must complete or have an active/unexpired Master Promissory Note (MPN).

Accepting (Borrowing) Federal Direct Parent PLUS Loans

- Parent borrowers may indicate the requested amount within their online application.

- Parent borrowers who do not indicate a requested amount will be contacted by the Financial Aid Office to document the requested amount.

- Parent borrowers must complete or have an active/unexpired PLUS Master Promissory Note (MPN).

All borrowers must complete Exit Counseling when transferring from or otherwise not returning to ICC or if the student’s enrollment level falls below half-time. This also applies to student borrowers who have withdrawn from ICC.

Students are notified to their personal email address as indicated on their FAFSA (where applicable) and to the student's ICC email. If our office does not have your personal email address, exit counseling notices will be sent to your address of record.

How to Enter Repayment

- Students with questions about repayment should refer to the U.S. Department of Education's Student Loan Repayment site for the most up-to-date information about repayment options.

- The U.S. Department of Education also provides borrowers with a Loan Simulator tool that can educate borrowers about repayment options.

- As a borrower, you have the right to access your student aid record, including loan records, via the National Student Loan Database Service at https://nslds.ed.gov. For information about how to access your financial aid record, you can also contact the ICC Financial Aid Office.

How to Avoid Loan Default

- ICC partners with Wright Internationall Student Services (WISS) to assist students with entering repayment and avoiding default.

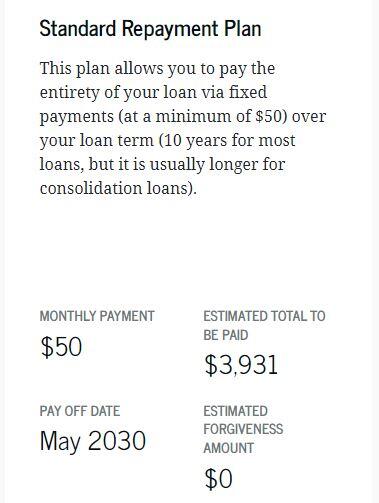

Example Repayment Plan

- The median student loan debt for ICC student borrowers as of the 2022-23 award year, is $3,464. A student could enter into a Standard Repayment Plan to pay off the balance within 10 years (the shortest repayment plan option) and expect the following:

HELPFUL LINKS

Phone: 620-331-4100

Location: Administration Building

Mon - Fri 8:00 a.m. to 5:00 p.m.

Contact Us

- Overview

- General Information

- Cost of Attendance

- Deadlines

- Disbursements

- Forms

- Online Financial Aid Access - Fall

- Online Financial Aid Access - Summer (opens in new window)

- Paying For College

- Satisfactory Academic Progress

- Scholarships

- Special or Unusual Circumstances

- Student Responsibilities

- Summer Financial Aid

- Verification

- Veteran Student Benefits

- Withdraw and Return of Aid

- FAQs

This site provides information using PDF, visit this link to download the Adobe Acrobat Reader DC software.